Click To Enlarge:

I'll speak to the effect on what these numbers mean on Monday.

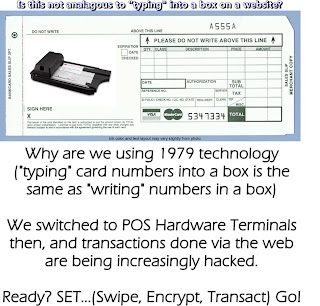

In the meantime, if you assume that our SwipePIN device is easy to use (Swipe instead of manually enter 14-16 digits, plus expiration date, pluss CVV number) and it's priced right (oh...it is), then 88% of the respondents said they would use it.

Wonder how many would use a "software only" solution, knowing their PIN is the Holy Grail?

Thursday, December 12, 2019

Wednesday, April 27, 2011

Visit the ePayment News Blog for Daily Coverage of the Payments Industry Since 2008

Payments Industry News (PIN) Debit Blog

Visit the ePayment News Blog for daily coverage of the Payments Industry.

Vist NFC Data, Inc. and Sqwizz.com to learn more about the world's first PIN Encrypted Multi-I/O NFC Reader, Writer and Viewer

Wednesday, August 12, 2009

Visa, MasterCard Seek Growth Abroad...

Reuters is running a story about how Visa and MC are looking to further penetrate emerging countries. Makes sense, but it would make even more sense if one of them would step up to the plate and offer a "truly" secure way for consumers to make online purchases. Debit has overtaken credit, Brick and Mortar is reeling in the wake of the economy...yet eCommerce is still growing. PIN Debit is the most popular form of payment even though signature debit is being pushed. So put it all together and what do you have? A PCI 2.x Certified 3DES DUKPT encrypted solution designed for credit, debit and PIN debit eCommerce transactions. How do you get it into the hands of consumers? Co-op distribution via your financial institutions who would benefit from Secure Two-Factor Authenticated log-on to their online banking sites and eliminate the threat of phishing, cloned bank websites and DNS hijacking. Now you've got everything you need to put together a real-time bill payment program, secure P2P and B2B real-time money transfer platform and the most secure eCommerce transaction in the business. Carpe Diem!

NEW YORK (Reuters) - Visa Inc (V.N) and MasterCard Inc (MA.N), the world's largest credit card networks, are counting on foreign markets for the growth that recession-bound U.S. consumers have been unable to provide.

Overseas markets have contributed to the bottom line at both Visa and MasterCard with double digit revenue growth rates in recent years, helped by a shift among consumers worldwide to using plastic where they once used cash and checks.

But foreign markets became truly crucial last year -- sustaining the revenue and earnings of both firms, despite a steep decline in credit card use in the United States -- still by far the largest market for both companies.

In comparison, emerging countries from Mexico to South Korea -- and even economies such as Japan and Germany that are developed, but are underpenetrated by credit and debit cards -- could become the engines of growth ahead.

"In Russia, in Brazil, in the United Arab Emirates, in Taiwan, even in China and Japan, while we see some good activity or strong activity, it's potentially much stronger when those economies start to do better," Visa's Chief Executive Joseph Saunders said in an interview.

"We are very entrenched in every one of those places and we are looking to get a lot more of attraction."

Continue Reading

Commerce Commission and Visa Reach Agreement on Interchange Fees

Commerce Commission and Visa reach agreement to settle credit card interchange fee proceedings

Release no 16, Issued 12 August 2009

The Commerce Commission has signed an agreement with the Visa International Service Association and Visa Worldwide Pte Limited (Visa) settling the Commission’s claims against Visa in relation to credit card interchange fees. The Commission’s proceedings allege that the rules of the Visa scheme providing for the payment of multilateral interchange fees, together with related rules, breached the restrictive trade practices provisions of the Commerce Act.

As a result of the agreement, Visa will make changes to the way the Visa scheme rules will apply in New Zealand. Those changes are: “The Commission considers that the agreed changes to the Visa rules will, over time, improve competition between companies that provide credit card services to retailers in New Zealand. Those changes are in the long-term best interests of both New Zealand consumers and retailers,” said Commerce Commission Chair Dr Mark Berry. “The Commission considers that this increased transparency will assist retailers and customers in making decisions about their payment choices.”

“The Commission considers that the agreed changes to the Visa rules will, over time, improve competition between companies that provide credit card services to retailers in New Zealand. Those changes are in the long-term best interests of both New Zealand consumers and retailers,” said Commerce Commission Chair Dr Mark Berry. “The Commission considers that this increased transparency will assist retailers and customers in making decisions about their payment choices.”

“The Commission welcomes Visa’s initiative in approaching the Commission with a forward looking resolution to the competition concerns that the Commission’s claim raised. This has enabled a resolution to be reached which supports the Commerce Act’s goal of promoting competition for the long term benefit of New Zealand consumers,” said Dr Berry. The agreement also reinforces the Commission’s stated approach to resolving issues in the most timely, cost-effective way.

Visa has agreed to contribute NZD 2.6 million towards the Commission’s costs to date in bringing these proceedings.

On the basis of the settlement agreement the Commission will be seeking leave to discontinue its proceedings against Visa in the High Court.

The Commission’s claims against ANZ National Bank Limited, Bank of New Zealand, Westpac New Zealand Limited, ASB Bank Limited, Kiwibank and TSB Bank Limited in relation to interchange fees in the Visa scheme continues, as does its claim against those banks, MasterCard and The Warehouse Financial Services Limited in relation to the MasterCard rules. The Commission’s remaining claims will be heard at the High Court in Auckland in October this year.

The Commission will be making no further comment at this time, due to the remaining claims yet to be heard.

A public version of the settlement agreement can be found attached to this media release on the Commission’s website.

International action on interchange fees. Interchange fees have been scrutinised by many international regulatory agencies. In 2003, the Reserve Bank of Australia moved to regulate the level of interchange fees, reducing the fees over time from 0.95 per cent of transaction value to less than 0.50 per cent. Public and private competition enforcement actions have also been brought in respect of interchange fee arrangements in numerous jurisdictions, including the United States and the UK.

Release no 16, Issued 12 August 2009

The Commerce Commission has signed an agreement with the Visa International Service Association and Visa Worldwide Pte Limited (Visa) settling the Commission’s claims against Visa in relation to credit card interchange fees. The Commission’s proceedings allege that the rules of the Visa scheme providing for the payment of multilateral interchange fees, together with related rules, breached the restrictive trade practices provisions of the Commerce Act.

As a result of the agreement, Visa will make changes to the way the Visa scheme rules will apply in New Zealand. Those changes are:

- Creditcard issuers will now be able to individually set the interchange ratesthat will apply to transactions using their credit cards, subject tomaximum rates determined by Visa. These rates will be publiclyavailable.

- Merchantswill no longer be prevented from applying surcharges to payments madeby credit cards or by specific types of credit cards. Merchants willalso be able to encourage customers to pay by other means.

- Visahas confirmed that non-bank organisations or companies who might wishto provide acquiring services to merchants are permitted to join theVisa network as acquirers if they meet relevant financial andprudential criteria.

“The Commission welcomes Visa’s initiative in approaching the Commission with a forward looking resolution to the competition concerns that the Commission’s claim raised. This has enabled a resolution to be reached which supports the Commerce Act’s goal of promoting competition for the long term benefit of New Zealand consumers,” said Dr Berry. The agreement also reinforces the Commission’s stated approach to resolving issues in the most timely, cost-effective way.

Visa has agreed to contribute NZD 2.6 million towards the Commission’s costs to date in bringing these proceedings.

On the basis of the settlement agreement the Commission will be seeking leave to discontinue its proceedings against Visa in the High Court.

The Commission’s claims against ANZ National Bank Limited, Bank of New Zealand, Westpac New Zealand Limited, ASB Bank Limited, Kiwibank and TSB Bank Limited in relation to interchange fees in the Visa scheme continues, as does its claim against those banks, MasterCard and The Warehouse Financial Services Limited in relation to the MasterCard rules. The Commission’s remaining claims will be heard at the High Court in Auckland in October this year.

The Commission will be making no further comment at this time, due to the remaining claims yet to be heard.

A public version of the settlement agreement can be found attached to this media release on the Commission’s website.

International action on interchange fees. Interchange fees have been scrutinised by many international regulatory agencies. In 2003, the Reserve Bank of Australia moved to regulate the level of interchange fees, reducing the fees over time from 0.95 per cent of transaction value to less than 0.50 per cent. Public and private competition enforcement actions have also been brought in respect of interchange fee arrangements in numerous jurisdictions, including the United States and the UK.

Background

Interchange fees. Eachtime a New Zealand Visa or MasterCard cardholder makes a purchase, thecard accepter (usually a retailer or service provider) pays a fee totheir own bank as part of the payment authorisation process. That feeis comprised mainly of the interchange fee, which is paid to thecardholder’s bank.

Visa and MasterCard purchases occur in a four-party card system, which operates as follows:

- Cardholder purchases goods or services from a merchant;

- Merchant sends the transaction details to its own bank (acquiring bank);

- Acquiring bank sends the transaction details to the bank or financial institution that issued the card (card issuing bank);

- Card issuing bank pays the acquiring bank the retail price of the goods or services less the interchange fee;

- Acquiring bank pays the merchant the retail price less a merchant service fee;

- Card issuing bank debits the retail price from the cardholder’s account.

Theretailer or service provider that has incurred the interchange fee isnot allowed to recover the fee from the cardholder, so must average outthe cost of that fee across all of their sales. This increases the costof every item or service sold by businesses which accept Visa orMasterCard. All customers of those businesses bear that averaged fee,regardless of whether the customer pays by credit card, cash, EFTPOS oranother payment method.

Figure of Flow of Payments in a Credit Card Transaction (see top of the page)

Credit card usage in New Zealand New Zealand New Zealand New Zealand

Relevant sections of the Commerce Act. Theproceedings are brought under sections 27 and 30 of the Commerce Act1986. Section 27 prohibits contracts, arrangements or understandingsthat substantially lessen competition. Section 30 prohibits pricefixing, which is when people or businesses that are in competition witheach other agree to control, fix or maintain the prices for the goodsor services that they supply. Price fixing is deemed to substantiallylessen competition under section 27 of the Commerce Act.

Penalties.The Commerce Act provides for penalties for price-fixing of up to thehigher of $10 million per breach, or either three times the commercialgain resulting from the breach or 10 per cent of a company’s turnover.

HomeATM Can Solve Your PCI Compliance Problem

National Retail Federation Poll: Small Retailers Struggling To Understand PCI

Nearly 86 percent are familiar with PCI, but nearly half can't demonstrate their compliance with the payment card standard

Aug 11, 2009 | 03:46 PM By Kelly Jackson Higgins

DarkReading

First the good news: Most small retailers say they know about the Payment Card Industry's Data Security Standard (PCI DSS). But the bad news is they don't necessarily understand it, nor can many of them prove their compliance with it, a new study by the National Retail Federation (NRF) says.

The big surprise was the high number of small businesses that are aware of PCI -- 86 percent -- and those that say PCI compliance makes them more secure -- 80 percent, according to Heather Foster, vice president of marketing for ControlScan, a PCI compliance vendor that conducted the survey along with the NRF and the PCI Knowledge Base. "A year ago, most of the small businesses we were talking to had never heard of PCI," Foster says. "We were pleasantly surprised with the [level] of awareness out there now."

"One of the first simple steps merchants can take on the road tocard data security is to check that they are using a secure paymentapplication or PED terminal that has been validated by an approvedlaboratory and is listed on our Website," Leach says.

Editor's Note: Which simply means that any merchant who uses our PCI 2.x certified device is good to go. One of the benefits of utilizing the HomeATM PED Terminal is that it costs less than half of it's closest competitor AND is encryption enabled. It was designed to encrypt the Track2 data for Zones 1-4 and the PIN is encrypted for Zones 1-5 meaning that the cardholders data is NEVER in the clear. This "clears" you from the ramifications that may be imposed by PCI.

But there's a gap between small businesses' PCI awareness and their perception of risk, the study found: Among the small merchants who had never suffered a breach, 72 percent said they think their risk of data hack is "low" or "not possible." Small merchants that had experienced data breaches not surprisingly saw things much differently, with 67 percent saying they are at a high or medium risk of attack.

"My biggest concern is that while these merchants [who haven't been breached] are at least making progress thinking that PCI is a good thing to do, they're not thinking they're at risk. They think they're invulnerable," Foster says.

The study, which surveyed 220 small retailers in ecommerce, retail stores, and mail/order telephone order businesses, also found that many of these enterprises are perplexed about PCI when it comes to better understanding it, implementing it, and the cost complying with it.

"Either make things easier to understand or offer more help for businesses to get compliant," one respondent commented in the survey. Another asked for PCI to have a "better understanding of how much small businesses can afford. Most solutions available are for large businesses and are expensive."

Editor's Note: HomeATM already made it easy. Our "SafeTPIN " would remove your business from the scope of PCI. You would not only be compliant, but you would be compliant at a "fraction of the cost" of other solutions...for more information on how we can do that, email us.

David Hogan, chief information officer for the NRF, says small retailers are understandably overwhelmed with compliance. "Until industry service providers and the PCI Security Standards Council make compliance easier to understand and less complex to implement, many small merchants will likely continue to be frustrated and bewildered, causing some of them to abandon the idea of compliance altogether," Hogan said in a statement.

The PCI Security Standards Council, meanwhile, is working on better educating small retailers about PCI and its implementation, says Troy Leach, technical director of the PCI Security Standards Council. Aside from working with the PCI vendor, payment, and small business community, the PCI Council also offers a priority approach framework, self-assessment questionnaires, and other PCI other resources.

"One of the first simple steps merchants can take on the road to card data security is to check that they are using a secure payment application or PED terminal that has been validated by an approved laboratory and is listed on our Website," Leach says.

Continue Dark Reading

Retail Payments Risk Forum Collaborate to Fight Payment Fraud

Retail Payments Risk Forum Collaborates to Fight Payments Fraud

The Atlanta Federal Reserve Bank’s anti-fraudcooperative is designed to bring together thought leaders in thepayments space to improve security. (from the Portals and Rails Blog) Portals and Rails, a blog sponsored by the Retail Payments Risk Forumof the Federal Reserve Bank of Atlanta, is intended to foster dialogueon emerging risks in retail payment systems and enhance collaborativeefforts to improve risk detection and mitigation. We encourage youractive participation in Portals and Rails and look forward tocollaborating with you.Collaboration to address payments risks and fraud

In the world of payments, all players share an interest in seeingthat risks are detected and mitigated quickly and effectively. However,when threats emerge, is it everyone for themselves? How does thevariety of interests and goals among all the players converge? In aprivate marketplace mixed with government actors, how can we workbetter together?Participants at a 2008 conference hosted by the Retail Payments Risk Forum discussed these issues and described the challenges and potential solutions. A year later, the findings of this forum are worth revisiting.

Information sharing

Real or perceivedinformation-sharing limitations among financial institutions,regulators, law enforcement, and others can substantially impedeaddressing retail payments risks on a timely and effective basis.Examples include inconsistent or incomplete payments data, varyingsuccess levels of intra- and interagency collaborations, varied andoverlapping jurisdictions, an incomplete network of memoranda ofunderstanding (MOUs), privacy restrictions, perceived barriers beyondlegal restrictions, competitive interests, costs, and trust.Suggestions for improvement in this area focused on:

- collection, consistency, and commonality of paymentsdata, better understanding of its utility, and analysis tools. Whiledata needs vary, a first step would be to focus on data elements ofshared interest. A working group could facilitate ongoing payments datacompilation and analysis efforts;

- formal and informal dialogue among various agencies and others, including simple measures such as shared contact lists;

- developmentof a “matrix” of various roles/responsibilities/information sources forshared use to facilitate more timely location of information andexpertise available; and

- a more systematic, organized mechanism for informationsharing, perhaps by establishing “brokers” for relevant informationsuch as payments data.

Many noted that communication about bad actors is often ad hocand that information is too widely dispersed to be useful and timely.Individual agency efforts, published enforcement actions, SAR filings,interbank collaborations, and industry self-regulatory efforts, whileall worthwhile, have not fully promoted effective information gatheringand sharing among all the parties who can have an impact. Suggestionsfor improvement in this area included:

- better understanding of risks across paymentchannels, both for front-end access point(s) and back-end processing,to mitigate fraudster arbitrage of vulnerabilities;

- publishing enforcement actions and related settlements more effectively as a deterrent;

- establishing a central “negative list” or “watch list” of bad actors;

- extendingregistration requirements for third parties participating in paymentsnetworks beyond existing targeted voluntary efforts;

- strengthening and clarifying regulatory guidance, such as that for counterfeit checks and consumer account statements;

- better educating consumers and banks regarding common issues;

- a more direct means of compensating victims;

- mining specific activity reports and other existing agency databases such as consumer complaints data; and

- potential new SEC codes within ACH to better track risks.

Participants identified collaborative efforts to help detect and/ormitigate retail payments risk issues and identified benefits and gaps.Examples included bank regulatory groups (intra- and interagency),national and regional law enforcement partnerships, interstatecollaboration, federal-state working collaborations, jointinvestigative task forces, examination- or case-driven ad hoc efforts, and industry data-sharing efforts. Potential avenues for improved collaborative action included:

- a law enforcement/regulatory payments fraud working group;

- a virtual collaborative forum via Web sites, e-mail lists, or regular phone calls;

- greater attention paid to requests for comments on proposed NACHA rules;

- examiner and law enforcement training opportunities;

- participation in and/or support for industry database sharing efforts;

- engagement with industry groups to improve best practices;

- a Web-based resource for consumers supported by all (“fraud.gov”);

- implementation of further MOUs among agencies; and

- efforts to identify fraud patterns across agencies, such as the federal government’s Eliminating Improper Payments Initiative.

Participants were asked to describe substantive retail payments riskissues that keep them up at night. Some common themes emerged,including:

- strengthening the oversight of third-party payments processors and others not covered by the Bank Service Company Act;

- quantifying and better managing the misuse of remotely created checks;

- understanding and mitigating risks associated with “cross-channel” fraud;

- “Know Your Customers’ Customer” due diligence, compliance, andassociated risks and potential liabilities for frauddetection/mitigation purposes;

- establishing a common means of redress for consumers regardless of the payment channel; and

- improving the clarity of consumer account statements by instituting standards and reducing jargon.

By Clifford S. Stanford, assistant vice president and director of the Retail Payments Risk Forum at the Atlanta Fed.

Tuesday, August 11, 2009

RBS WorldPay to Offer VeriShield Protect

- Whitepapers:

- Understanding End to End Encryption

- Protecting Cardholder Data: The Elusive Goal

- All-New Mini Site

Interactive:

San Jose, Calif., Aug. 11, 2009--VeriFone Holdings, Inc. (NYSE: PAY) today announced that RBS WorldPay, the fastest growing top ten payment processor in the US, has agreed to work jointly and expeditiously towards marketing VeriFone's VeriShield Protect end-to-end solution for encrypting payment card data.

RBS WorldPay is the first merchant acquirer to endorse a commercial end-to-end encryption solution. By encrypting the card number on swipe, right at the point of sale, RBS WorldPay merchants who choose the VeriShield Protect solution will be able to dramatically reduce both their own risk and that of their customers as well.

"RBS WorldPay merchants and prospects are telling us they want to significantly reduce the impact of PCI compliance on their business - and they want a solution their processor endorses," said Ian Stuttard, president and CEO of RBS WorldPay. "VeriShield Protect will easily integrate into multi-lane retailers' existing systems and networks."

VeriFone's VeriShield Protect eliminates usable cardholder data from the merchant's POS applications, networks and servers, using AES-level encryption that preserves existing card track data formats so it works transparently with retailers' existing payment infrastructure.

"RBS WorldPay is taking a leadership position in addressing merchant concerns with potential liability over data breaches and the complexity of complying with card issuer requirements," said Douglas Bergeron, VeriFone, CEO. "Using VeriShield Protect's true hardware-fortified end-to-end encryption, usable card data can be removed from the merchant environment, eliminating the leading source of compromise."

With end-to-end encryption, even in the event of a breach of the retailer's system, any stolen data would be unusable. Because VeriShield Protect preserves the format of the card data there is no need to redesign the POS applications to deal with a new data format. In addition to encrypting card data, VeriShield Protect monitors all systems in real time at the device level via VeriShield Secure Device Management Service (VSDMS), so if a breach occurred the retailer would be immediately alerted. In addition, data encryption keys can be managed remotely as part of the device management service.

About RBS WorldPay, Inc.

RBS WorldPay, Inc. is a leading, single-source provider of electronic payment processing services - including credit, debit, EBT, checks, gift cards, e-commerce, customer loyalty cards, fleet cards, ATM processing and cash management services.

RBS WorldPay is the US-based payment processing division of the Royal Bank of Scotland Group plc. For more information, please visit www.RBSWorldPay.us .

About The Royal Bank of Scotland Group (RBS)

The RBS Group is a financial services company providing a range of retail and corporate banking, financial markets, consumer finance, insurance, and wealth management services. The RBS Group operates in the Americas, Asia and the Middle East serving more than 40 million customers. For more information, please visit www.RBS.com .

About VeriFone Holdings, Inc. (www.verifone.com )

VeriFone Holdings, Inc. ("VeriFone") (NYSE:PAY) is the global leader in secure electronic payment solutions. VeriFone provides expertise, solutions and services that add value to the point of sale with merchant-operated, consumer-facing and self-service payment systems for the financial, retail, hospitality, petroleum, government and healthcare vertical markets. VeriFone solutions are designed to meet the needs of merchants, processors and acquirers in developed and emerging economies worldwide.

Source: Company press release.

First Data Renews PNC Processing Agreement

First Data renews PNC processing agreement

Denver, August 11, 2009--Global technology and payments processing leader First Data today announced that The PNC Financial Services Group (NYSE: PNC) has renewed and expanded its agreement for transaction processing services. Under the agreement, First Data will provide signature debit, PIN debit and ATM processing services, ATM terminal driving, credit card, small business and home equity loan processing, fraud and collections services, remittance processing, prepaid processing as well as plastic, statement and letter production services.

PNC will transfer some credit card processing not currently with First Data as well as adding PIN debit and ATM processing it had gained through its acquisition of National City Corp. PNC acquired National City on Dec. 31, 2008.

First Data has provided transaction processing services to PNC since 1992 and services more than 15 million total accounts on file for PNC. Financial terms of the agreement are not being disclosed.

About PNC

The PNC Financial Services Group, Inc. (www.pnc.com ) is one of the nation's largest diversified financial services organizations providing retail and business banking; residential mortgage banking; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management; asset management and global fund services.

About First Data

First Data powers the global economy by making it easy, fast and secure for people and businesses to buy goods and services using virtually any form of electronic payment. Whether the choice of payment is a gift card, a credit or debit card or a check, First Data securely processes the transaction and harnesses the power of the data to deliver intelligence and insight for millions of merchant locations and thousands of card issuers in 36 countries. For more information, visit www.firstdata.com .

Source: Company press release.

Ukash Available in Poland

Ukash virtual cash extends to Poland with epay

Poland, August 10, 2009--As Ukash, the online payment specialist, continues in its quest to make online shopping available to everybody, anywhere in the world, the company has signed a significant global deal with epay, a Division of Euronet Worldwide, Inc. – a leading provider of payment services and technology – to extend the availability of its e-cash vouchers to epay retailers across Poland.

The Ukash partnership with epay enables Ukash to expand into 6,000 epay locations across Poland, and the deal offers all internet users the opportunity to pay, play and shop online using cash without having to pay for a prepaid card.

With the growth of the e-commerce market in Poland – one that is dominated by payment methods of cash on delivery and bank transfers – the Ukash deal with epay allows online merchants to tap into the large base of consumers preferring to use cash as a safer method for online purchases.

Unlike some other financial products in Poland, Ukash vouchers do not attract a service or convenience fee. Consumers simply exchange their cash for a unique 19-digit code to use online. This provides them with a secure payment system where they don’t need to reveal any financial information, enabling those without access to credit or debit cards that can be used online – or those with fears of online fraud – to enjoy online shopping.

Mark Chirnside, chief executive officer Ukash, explained, “Given that a significant number of banked customers in Poland cannot use their cards online – as many cards are not accepted on the internet – this country is a key growth market for Ukash and we are pleased to be able to extend the availability of our product to physical points of purchase. By partnering with epay we are able to reach a huge number of potential new customers and expand our global footprint to allow more consumers in Poland to pay, play and shop online using cash.”

“This deal also opens the virtual door for many online retailers as they can now offer alternative payment methods and attract the cash consumer, as well as eliminate any risk of online fraud.”

“epay is pleased to be able to partner with Ukash in Poland, thereby combining the strengths of both businesses to offer consumers more convenient locations to obtain Ukash vouchers – a safe and alternative method of online payment,“ said Piotr Adamek, Country Manager, epay Poland. “Utilising our Polish cash collection network, we can deliver a value-added service to Ukash customers, further extending our payment service and technology offering.”

From today, Ukash vouchers will be available at 6,000 physical point of sale terminals operated by epay at independent supermarkets, petrol stations, call shops, drug stories and convenience stores in Poland. The vouchers will be available in PLN 20, 25, 100, 200, 500, 750 and can be combined, split and/or converted.

Ukash is undergoing a period of rapid global growth and in the last few months has expanded its offer in Germany, Australia and Spain with epay. This deal is expected to lead to further new countries being added in the coming months.

About Ukash®

Ukash® is a globally-recognised e-commerce payment method to enable online purchases using cash, providing freedom from credit and debit card fraud, repudiations and charge-backs, and protecting personal identity. Ukash® is regulated by the UK Financial Services Authority (FSA) and operates as one of the only a small number of Electronic Money Institutions, a status that allows a single maximum online cash payment transaction of up to £500/€750. Uniquely numbered Ukash® vouchers are widely available through payment terminals in retail outlets across Europe and South Africa. And from spring 2009, Ukash vouchers will also be issued online from the company’s website in most European territories. The technology behind Ukash is protected by several patents registered across the Smart Voucher database and functionality and is, as such, protected by Patent Law in all the major economies of the world. Ukash® is a registered trademark of Smart Voucher Ltd. In 2008, Ukash® established a strategic partnership with South African payments giant Blue Label Telecoms to develop the brand’s services. For more information please visit www.ukash.com

About epay

epay, a Division of Euronet Worldwide, Inc. (NASDAQ: EEFT), is a global business with a retail network of approximately 227,000 locations across a number of international markets including the UK, Germany, Spain, Italy, Australia, New Zealand, USA, Poland, Romania, Austria, Switzerland and Ireland. epay enables service providers to deliver electronic payment products and services to consumers through an extensive worldwide retail network. epay’s proprietary payment technology is backed by a cash collection service that manages the payment of funds back to the service providers and a range of marketing solutions to assist both the retailer and service provider to maximise their sales opportunities. In 2008 epay processed over 700 million payment transactions with a total face value of $11 billion. epay’s product portfolio includes top-up or recharge services for prepaid mobile airtime, prepaid debit cards and e-wallets; payment services for bills, road tolls and money transfer; and marketing and distribution services for gift cards, digital content and transport tickets. epay’s commitment to customers is supported by a strong roadmap of innovative new epayment products to bring to market. epay’s corporate headquarters is located in London, United Kingdom. For more information please visit www.epayworldwide.com or contact Angela Wong, Global Marketing Manager on awong@epayworldwide.com or +44 (0) 7787 225 164.

Source: Company press release.

Electronic B2B Payments Study

Report on the benefits of electronic B2B payments

Boston, August 11, 2009--With current economic conditions forcing enterprises to focus on cost containment, top-performing organizations are driving efficiencies within the final phase of the accounts payable process to unveil a wealth of cost and time benefits, according to a new research study published by Aberdeen Group, a Harte-Hanks Company (NYSE: HHS).

The E-Payables: Electronic Payments research report, which examined the strategies, intentions, and performance of over 140 enterprises, found that nearly 70% of enterprises place a critical / high-priority level on improving overall payment processes and procedures, a figure that reinforces the notion that overall financial success within the enterprise rests on the operational shoulders of the accounts payable department.

"Top-performing enterprises realize the value in automating the final phase of the A/P process," said Christopher Dwyer, research analyst and author of the study, Aberdeen. "By leveraging electronic payment methods, such as ACH, commercial cards and wire transfer, they have significantly cut payment-processing costs in addition to reducing the risk of payment fraud."

In addition to driving payment-processing costs that are nearly 14.6-times lower than all other organizations, leading enterprises utilized a core set of A/P capabilities and technologies to achieve superior performance. These organizations are:

- 53% more likely to have electronic payments requirements established as a standard means of conducting business with key suppliers

- 43% more likely to integrate payment solutions with existing A/P systems

- 42% more likely to have standardized payment processes

A complimentary copy of this report is made available due in part by the following underwriters: SunGard, SunTrust, and Visa. To obtain a complimentary copy of the report, visit: http://www.aberdeen.com/link/sponsor.asp?cid=5984 .

For additional access to complimentary Global Supply Management Research, please visit http://research.aberdeen.com/index.php/-global-supply-management

About Aberdeen Group, a Harte-Hanks Company

Aberdeen provides fact-based research and market intelligence that delivers demonstrable results. Having queried more than 30,000 companies in the past two years, Aberdeen is positioned to educate users to action: driving market awareness, creating demand, enabling sales, and delivering meaningful return-on-investment analysis. As the trusted advisor to the global technology markets, corporations turn to Aberdeen for insights that drive decisions.

As a Harte-Hanks Company, Aberdeen plays a key role of putting content in context for the global direct and targeted marketing company. Aberdeen's analytical and independent view of the "customer optimization" process of Harte-Hanks (Information - Opportunity - Insight - Engagement - Interaction) extends the client value and accentuates the strategic role Harte-Hanks brings to the market. For additional information, visit Aberdeen or call (617) 854-5200, or to learn more about Harte-Hanks, call (800) 456-9748.

Source: Company press release.

Payment Data: Don't Store It, Don't Handle It

CyberSource is holding a webinar entitled Payment Data: Don't Store It, Don't Handle It. It's the best way to remove yourself from the scope of PCI Compliance. Simply remove yourself from all contact with payment data. It the way HomeATM designed it's eCommerce platform.

Our PCI 2.x Certified PIN Entry Device encrypts the data instantaneously, and simply utilizes the "internet" as the conduit with with to send the encrypted packet. Since the data is never in the clear, a web merchant would be in the clear when it comes to PCI Compliance. It's easy to protect your business from potential breaches with HomeATM's secure 3DES DUKPT end-to-end encryption. And you'll save money on processing costs with True PIN Debit.

Maintaining payment security doesn’t require adding even more proverbial locks and bolts to your infrastructure. In fact, you can secure your payment process – including complying with PCI-DSS standards - with less cost, complexity, and time. In the upcoming CyberSource webinar Payment Data: Don’t Store It, Don’t Handle It, you’ll see how your peers are adopting a safer, more secure approach by eliminating all contact with payment data – a strategy we call Enterprise Payment Security 2.0.

Our PCI 2.x Certified PIN Entry Device encrypts the data instantaneously, and simply utilizes the "internet" as the conduit with with to send the encrypted packet. Since the data is never in the clear, a web merchant would be in the clear when it comes to PCI Compliance. It's easy to protect your business from potential breaches with HomeATM's secure 3DES DUKPT end-to-end encryption. And you'll save money on processing costs with True PIN Debit.

Maintaining payment security doesn’t require adding even more proverbial locks and bolts to your infrastructure. In fact, you can secure your payment process – including complying with PCI-DSS standards - with less cost, complexity, and time. In the upcoming CyberSource webinar Payment Data: Don’t Store It, Don’t Handle It, you’ll see how your peers are adopting a safer, more secure approach by eliminating all contact with payment data – a strategy we call Enterprise Payment Security 2.0.

Subscribe to:

Comments (Atom)