Wednesday, August 12, 2009

Visa, MasterCard Seek Growth Abroad...

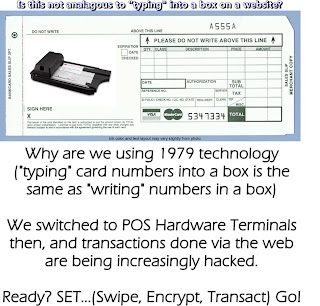

Reuters is running a story about how Visa and MC are looking to further penetrate emerging countries. Makes sense, but it would make even more sense if one of them would step up to the plate and offer a "truly" secure way for consumers to make online purchases. Debit has overtaken credit, Brick and Mortar is reeling in the wake of the economy...yet eCommerce is still growing. PIN Debit is the most popular form of payment even though signature debit is being pushed. So put it all together and what do you have? A PCI 2.x Certified 3DES DUKPT encrypted solution designed for credit, debit and PIN debit eCommerce transactions. How do you get it into the hands of consumers? Co-op distribution via your financial institutions who would benefit from Secure Two-Factor Authenticated log-on to their online banking sites and eliminate the threat of phishing, cloned bank websites and DNS hijacking. Now you've got everything you need to put together a real-time bill payment program, secure P2P and B2B real-time money transfer platform and the most secure eCommerce transaction in the business. Carpe Diem!

NEW YORK (Reuters) - Visa Inc (V.N) and MasterCard Inc (MA.N), the world's largest credit card networks, are counting on foreign markets for the growth that recession-bound U.S. consumers have been unable to provide.

Overseas markets have contributed to the bottom line at both Visa and MasterCard with double digit revenue growth rates in recent years, helped by a shift among consumers worldwide to using plastic where they once used cash and checks.

But foreign markets became truly crucial last year -- sustaining the revenue and earnings of both firms, despite a steep decline in credit card use in the United States -- still by far the largest market for both companies.

In comparison, emerging countries from Mexico to South Korea -- and even economies such as Japan and Germany that are developed, but are underpenetrated by credit and debit cards -- could become the engines of growth ahead.

"In Russia, in Brazil, in the United Arab Emirates, in Taiwan, even in China and Japan, while we see some good activity or strong activity, it's potentially much stronger when those economies start to do better," Visa's Chief Executive Joseph Saunders said in an interview.

"We are very entrenched in every one of those places and we are looking to get a lot more of attraction."

Continue Reading

Subscribe to:

Post Comments (Atom)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=1b3c877b-f4b8-4451-bcb4-df0044920fb0)

No comments:

Post a Comment